Contact the financial aid office to see what aid is available for the Summer semester.

By providing a telephone number and submitting this form you are consenting to be contacted by SMS text message. Message & data rates may apply. You can reply STOP to opt-out of further messaging.

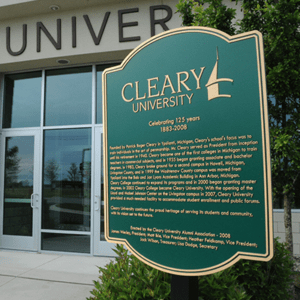

Cleary graduates use their business arts education to become the employees, entrepreneurs, and leaders who transform the marketplace…and the world.

Follow Us

HOWELL

DETROIT

SUMMER HOURS: (May 12 to Aug. 4)

Mon-Thur | 7am to 5pm

Fri-Sun | Closed