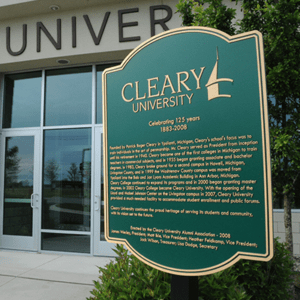

Cleary university

Federal Direct Subsidized and Unsubsidized Loans (previously known as Stafford Loans) are part of the Federal Direct Loan Program, which is offered through the U.S. Department of Education. Loans are aid that will need to be repaid, with interest, after you graduate or leave college. Most student loans are Direct Loans.

You are considered for these loans when applying for financial aid and completing the FAFSA. You will be required to complete Direct Loan Program requirements in order to receive any Direct Loan funds, like Entrance Counseling and Master Promissory Note

| Direct Loan Type | Direct Loan Borrower | Annual Award (subject to change) |

| Direct Subsidized Loan | Eligible undergraduate students with demonstrated financial need | Up to $5,500 depending on grade level and dependency status |

| Direct Unsubsidized Loan | Eligible undergraduate, graduate, and professional students | Up to $20,500 (minus any subsidized amounts received for the same period) depending on grade level |

| Direct PLUS Loans |

|

Maximum amount is the cost of attendance (determined by the school) minus any other financial aid the student receives |

Direct Subsidized Loans: Direct Subsidized Loans are offered to undergraduate students with financial need. They have a low, fixed interest rate and do not accrue interest while the student is enrolled at least half-time in a degree program. Students are also given a grace period of six months after graduating or drop below half-time before having to make payments. Direct Subsidized Loans are available only to undergraduate borrowers.

Direct Unsubsidized Loans: Direct Unsubsidized Loans are available to undergraduate and graduate students with or without financial need. These loans accrue interest while the student is in school and during the six month grace period. Students may defer interest payments until after they graduate, but doing so will result in a higher loan payment over the life of the loan. Reach out to your loan servicer for more information.

Important Notice: Both of these loans have origination fees, so the amounts applied to your university student account are less than amounts listed on your Financial Aid Offer. These fees are adjusted each fall due to federal sequestration legislation. Interest rates on these loans change each June with changes becoming effective on July 1. Find more information about your loans, interest rates, and loan amounts on the Federal Student Aid Loan Information page.

If you are not eligible for Direct Loans or need additional resources to cover college costs, you may want to apply separately for a supplemental loan through the federal government or a private lender. Private student loans provided by banks, credit unions, and other lenders can help bridge the gap between the financial aid you may have already received for college and the total cost of attendance.

We have partnered with Elm Select to help our students compare private loans and make the best decision for their financial needs. There are options for undergraduate students, graduate students, and parents of students:

The U.S. Department of Education makes Direct PLUS Loans to eligible parents and graduate or professional students through schools participating in the Direct Loan Program. Here’s a quick overview of Direct PLUS Loans:

Use the following link to apply for a PLUS loan:

By providing a telephone number and submitting this form you are consenting to be contacted by SMS text message. Message & data rates may apply. You can reply STOP to opt-out of further messaging.

Cleary graduates use their business arts education to become the employees, entrepreneurs, and leaders who transform the marketplace…and the world.

Follow Us

HOWELL

DETROIT

SUMMER HOURS: (May 12 to Aug. 4)

Mon-Thur | 7am to 5pm

Fri-Sun | Closed