The Accounting concentration within the Bachelor of Business Administration (BBA) in Accounting & Finance prepares students for professional careers in accounting across business, nonprofit, and public sectors. Students gain a strong foundation in financial, managerial, and cost accounting while developing advanced skills in auditing, taxation, analytics, and reporting. Emphasis is placed on applying accounting principles to real-world business decisions, ethical practice, and regulatory compliance.

This concentration equips graduates to pursue a range of professional roles—including accountant, auditor, tax specialist, and financial analyst—or continue their studies at the graduate level to prepare for the Certified Public Accountant (CPA) or Certified Management Accountant (CMA) credential.

Designed in alignment with industry and accreditation standards, the program reflects current trends in accounting education and evolving state licensure requirements. Whether students plan to work in corporate, nonprofit, or public accounting environments, this concentration develops the technical expertise, ethical grounding, and professional judgment necessary to succeed in a rapidly changing financial landscape.

Graduates of the accounting program will be able to:

By providing a telephone number and submitting this form you are consenting to be contacted by SMS text message. Message & data rates may apply. You can reply STOP to opt-out of further messaging.

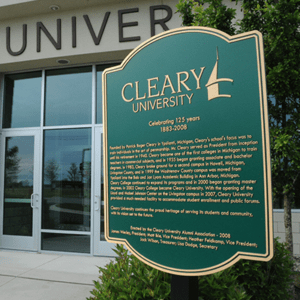

Cleary graduates use their business arts education to become the employees, entrepreneurs, and leaders who transform the marketplace…and the world.

Follow Us

HOWELL

DETROIT

Mon-Fri | 9am to 5pm

Sat-Sun | Closed