BBA – Corporate Accounting

- Undergraduate

- Bachelor of Business Administration (BBA)

- 120 credits

- Online

The Bachelor of Business Administration (BBA) degree in corporate accounting is designed to prepare you for an accounting career in a corporate environment. This program gives a strong foundation in financial and managerial accounting. The curriculum is designed to prepare you for the Certified Management Accountant (CMA) examination. Graduates of this program will be well prepared to meet the professional challenges faced by accounting professionals in a corporate business environment.

As a graduate from this program, you can work as a corporate accountant, controller, credit manager, risk manager, and business consultant. Students who have an aptitude for international accounting can work for multinational companies. Career opportunities in accounting are projected to grow steadily in the next decade.

Graduates of the corporate accounting program will be able to:

General Education (see General Education Requirements for details) 30 credits

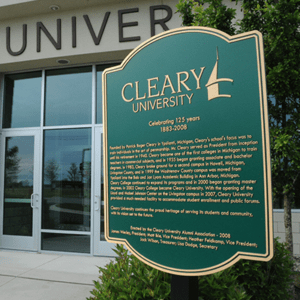

Cleary graduates use their business arts education to become the employees, entrepreneurs, and leaders who transform the marketplace…and the world.

Follow Us

HOWELL

DETROIT